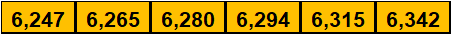

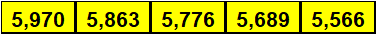

SPX analysis: I updated my charts and looked at a few EW counts I keep track besides my weekly wave counts I trade on. The count most accurate so far is when I use the 5408 low (Sep 2024), which is a larger degree count, the levels match every low we had in the last 2 months:

SPX closing lows: 5,861 5,878 5666

I haven't seen a double bottom at all in the last 2 weeks, is the opposite, new lows, therefore I'm continuing with the trend downwards but buying calls along the way in case it turns up in the next 2 weeks. The US economy is going through new changes (tariffs, removing regulations, opening energy avenues) so it might be a grind for a little while but the important issue for the markets is to find a temporary or permanent bottom and retrace to get the market some breathing room. The next level down is 5566 & 5408, so if we go lower than 5566, then we could visit 5408 and that should be the last bottom for now, I don't see going lower than that. Good trading to all.